- Alyssa Hardbower

- April 14, 2025

- 10 Minute Read

Topics in This Article

North Carolina Solar Discounts

Whether you’re tired of paying high electric bills and watching utility rates increase, or you’re ready to switch to clean power, now’s the perfect time to look into your energy independence.

There are a number of powerful financial incentives available to North Carolina residential, commercial, and nonprofit solar projects in 2025. Here’s a rundown of national and local North Carolina solar incentives you may be eligible to tap into this year.

Upfront Tax Disclaimer

We are not tax professionals (surprise!) and this post does not constitute professional tax advice or guidance. If you end up going on your solar journey with us, we can connect you with Lucas Tax and Energy, a CPA specializing in energy related tax issues, that we keep on retainer as a service to our customers.

part 1

Residential Solar Incentives

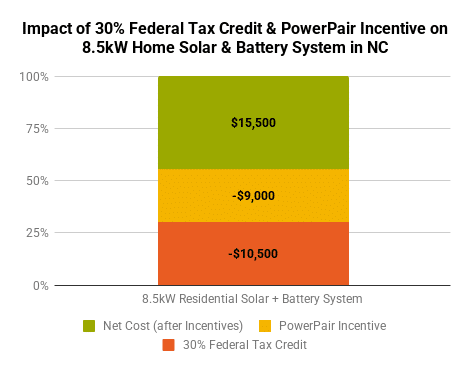

New and existing NC homes that install solar in 2025 may be eligible to take advantage of the 30% Federal Solar Investment Tax Credit (ITC) for solar alongside powerful local utility incentives. When these incentives are applied to our average sized home solar and battery system (around 8.5kW with 1 battery), you can expect to see roughly $19,500 off of our average turn-key price of $35,000.

Let’s dive into the specifics in this section!

Duke Energy PowerPair Incentive

For New Solar + Battery Systems

Homes that install a new solar system with battery storage are eligible for the PowerPair Incentive, for up to $9,000 in savings depending on what size solar + battery system you install. This incentive can also stack with the 30% Tax Credit for solar, bringing your total savings up to 50% off the original system cost. There is an application process and space is limited to first come, first served. If you’re interested in taking advantage of this incentive, let us know so we can get your ducks in a row for you to receive the incentive! 🦆

Duke Energy Battery Control Program

With the introduction of Duke Energy’s PowerPair Incentive for new solar + battery systems, Duke Energy also introduced a secondary program that new and existing solar + battery customers can take advantage of. This program is called Battery Control and goes by ‘Power Manager’ (Duke Energy Carolinas) or ‘Energy Wise’ (Duke Energy Progress) depending on your territory.

Duke Energy’s Battery Control Incentive (Power Manager or Energy Wise) is available for any Duke Energy customers who want to opt in with an eligible battery. The only people who can’t opt in are the PowerPair RSC (Residential Solar Choice Rider)/TOU (Time-of-Use) folks who are enrolled in the Data-Only program for Battery Control.

The incentive value is based on battery size – more specifically, the continuous discharge capacity of your battery – and a capability factor.

Here’s a breakdown of what the incentive could look like based on your battery type:

| Battery Model & Name | Energy Capacity | Continuous Discharge Capacity | What You'll Get Monthly | What You'll Get Annually |

|---|---|---|---|---|

| Franklin aPower2 | 15 kWh | 10 kW | $46 | $552 |

| Tesla Powerwall + | 13.5 kWh | 5.8 kW | $26 | $312 |

| Tesla Powerwall 2 | 13.5 kWh | 5 kW | $23 | $276 |

| Tesla Powerwall 3 | 13.5 kWh | 11.5 kW | $52 | $624 |

| Enphase IQ Battery 5P | 5 kWh | 3.84 kW | $17 | $204 |

| Generac PWRcell | 9 kWh - 36 kWh | 3.4 kW - 7.6 kW | $15 - $35 | $180 - $420 |

The Battery Control incentive can be applied to multiple solar batteries, but the total combined incentive is capped to a residential interconnection limit of 20 kW. So the maximum incentive you could receive would be $91 a month or $1,092 annually.

Where does ‘battery control’ come in? By opting in to this program to receive the incentive, Duke Energy will have access to control your battery storage (with certain limitations). Duke Energy will send signals to your battery about 30-36 times a year to manage its settings—like charging, discharging, storing energy, returning settings to normal. These times are called Control Events. Your battery won’t be discharged below 20% capacity and you’ll have the ability to opt out of up to 4 events per year.

30% Federal Solar Investment Tax Credit for Homes

The 30% Federal Solar ITC was established in 2005 by the Energy Policy Act. At first it was intended to last one year, but after several sunny extensions we’re excited to report this incentive will be here to stay at 30% until 2032. You can learn more about the history of the tax credit and the most recent extension from the signing of the Inflation Reduction Act here.

How Does the Solar Tax Credit Work?

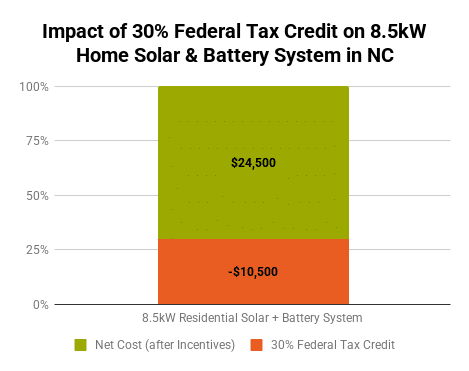

Homeowners who pay federal taxes and have a solar system placed into service by the end of the year are eligible for a tax credit worth 30% of the cost of their system.

This means, for an average $35,000 solar system a homeowner can claim a $10,500 credit when filing their 2024 taxes. In this example, if they owe $11,000 in taxes, they will only need to pay $500 in taxes after claiming the solar ITC ($11,000 – $10,500 = $500).

The great part is, there’s no cap on the system value that can be claimed via the Federal Solar Tax Credit. However, there are limits on what is eligible to include in the system cost. System components that can be counted toward the credit include solar panels, racking/mounting equipment, inverters, balance of system (wire, conduit, junction boxes, etc), installation labor (including design, inspection, and permitting fees), and sales & use taxes.

*Note: energy efficiency upgrades are not included on the above list! We have seen several solar companies try to include items like insulation, LED bulbs, smart thermostats, etc. as a solar system upgrade. These items are not eligible for the solar ITC.

Other NC Residential Solar Incentives

With many new players joining the hot NC solar market, we’d like to throw out a word of caution to be skeptical if you see an “NC state tax credit” on your solar proposal. Beyond the incentives we’ve outlined, no other significant incentives are available at the Federal or state level in North Carolina. As always, when working with a solar installer, make sure pricing is transparent and terms are clearly defined. Here are a few other things to look for on your solar proposal.

part 2

Solar Incentives for Businesses in NC

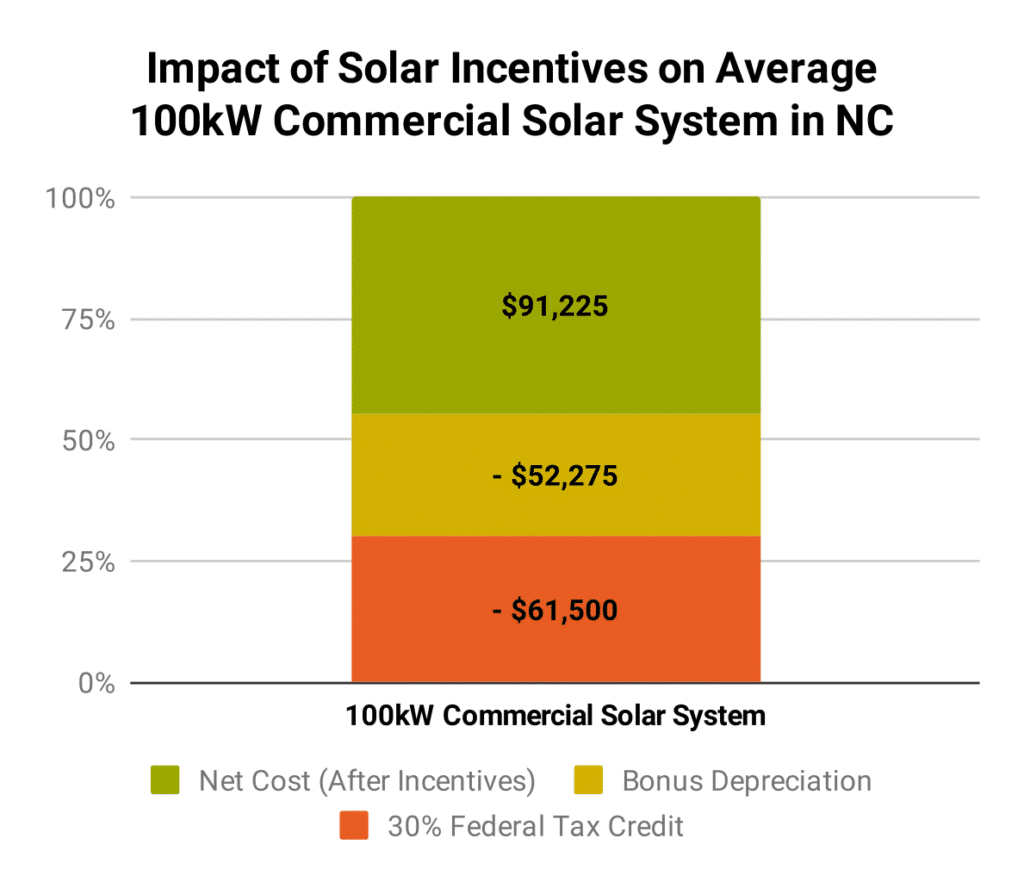

There are even more solar incentives available for North Carolina businesses to take advantage of in 2025. When combined, the 30% Federal Solar Investment Tax Credit (ITC), Accelerated Bonus Depreciation, and the US Department of Agriculture (USDA) Rural Energy for America Program (REAP) Grant make it possible for businesses to offset 70-90% of the cost of going solar.

While situations where all 4 of these incentives stack together to reach 90% offset are rare, most of our commercial solar customers will see savings of between 40-70% on their solar system with some combination of those incentives.

30% Federal Solar Investment Tax Credit for Businesses

Businesses that pay federal taxes and have a solar system placed into service by the end of the year are eligible for a tax credit worth 30% of the cost of their system.

This means, for an average $205,000 solar system a business can claim a $61,500 credit when filing their 2023 taxes. This would bring the net cost of the solar system down to $143,500. Similar to a home solar system, there is no cap on a commercial solar system value that can be claimed using the Federal Solar Tax Credit. Spoiler alert: The savings get even more exciting when you factor in additional Bonus Deprecation savings on top of that.

More information about the Federal Tax Credit can be found on DSIRE.

Bonus Depreciation

Commercial solar systems are also eligible for accelerated first year bonus depreciation. Most assets are depreciated over a long period of time, but this incentive gives business owners the benefit of additional tax savings. The bonus depreciation rate is currently set at 40% in 2025 and set to decrease to 20% in 2026, before sunsetting to 0% in 2027.

The value of depreciation depends on the business’ effective tax rate. We recommend consulting your tax professional for a full breakdown of how this would work for you business. If you end up going on your solar journey with us, we can connect you with Lucas Tax and Energy, a CPA specializing in energy related tax issues, that we keep on retainer as a service to our clients.

More information about bonus depreciation can be found at DSIRE: MACRS Depreciation.

Duke Energy Solar Rebate for Business

USDA REAP Grant

The USDA Rural Energy for America Program (REAP) Grant provides grants and loans to farmers and businesses for renewable energy projects, energy efficiency upgrades, and energy audits. As of now, the REAP grant is currently set at a 25% award, with applications being accepted twice a year in the Spring and Fall. To qualify for the USDA REAP Grant, you must be an Agricultural Producer or Rural Small Business.

Recent Updates

In December 2024, the USDA paused the additional 25% Investment Tax Credit (ITC) boost due to high application volume and full allocation of available funds. The currently available 25% award is based on the USDA’s existing budget. After July 1, we anticipate the potential for a return to the 50% award, though this is not guaranteed. If you prefer to wait for this chance, the REAP grant process takes a minimum of nine months so plan accordingly.

Application Process

Make sure to let us know you’re interested with enough time ahead of Spring and Fall application deadlines. We are happy to take a look at your project to let you know whether you are eligible for the REAP grant and help evaluate your funding options.

Agricultural Producer

Individual or entity directly engaged in agricultural production whereby 50% or greater of its gross income is derived from agricultural production.

Rural Small Business

An entity or utility that meets the Small Business Administration’s (SBA) Small Business Size Standards by the North American Industry Classification System (NAICS) found in 13 Code of Federal Regulations (CFR) Part 121.

More information about the USDA REAP Grant can be found at DSIRE.

Duke Energy Solar Rebate for Businesses

Unfortunately, the Duke Energy PowerPair Rebate is not available to commercial businesses. There is no news on a Duke Energy Solar rebate for businesses in 2024, but we’ll keep this page updated if any other North Carolina solar incentives emerge.

part 3

Nonprofit Solar Incentives

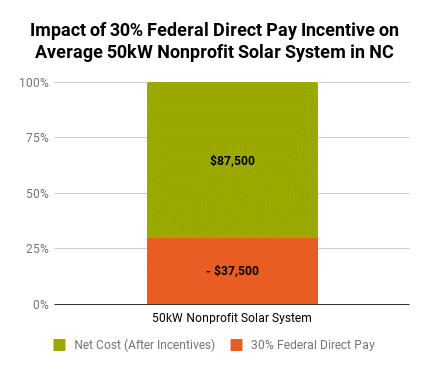

Exciting solar news! Even though the Duke Solar Rebate has expired, there is still an opportunity for North Carolina nonprofits to claim a solar incentive with the 30% Direct Pay option. Learn more below!

30% Federal Direct Pay Reimbursement

Historically, nonprofits & government organizations were not eligible for the 30% Solar Investment Tax Credit (ITC) since nonprofits do not have tax liability. However, the signing of the Inflation Reduction Act (IRA) expands the 30% incentive to include nonprofits and government organizations through a Direct Pay Reimbursement. This is huge news in the solar world, and opens up many more opportunities to expand solar across nonprofit and government-owned roofs!

Other Solar Incentives for Nonprofits

Similar to businesses, the Duke Energy PowerPair rebate is not available to nonprofits at this time. We will update this guide as soon as we hear of any other solar funding opportunities.

Make a resolution to stabilize your energy bills in 2024!

Pheeeeeeew…congrats, you made it to end!

There are many reasons to go green, and several incentives that will save you even more. Going solar is a big decision, with a big reward. Let us know how we can help you tap into solar incentives and take control of your power this year.

2024 North Carolina Solar Incentives

30% Federal Solar Tax Credit

Residential ・ Commercial

Available to homes and businesses, the Federal Solar Tax Credit is a tax credit that you can claim for installing a solar or battery system on your property and is worth 30% of system costs.

30% Direct Pay Solar Credit

Nonprofit ・ Government

Tax-exempt, nonprofit, and government organizations can now tap into solar cost savings through a Direct Pay reimbursement, worth at least 30% on system costs.

USDA REAP Grant

Farms ・ Rural businesses

The USDA REAP program provides grant funding to farms and rural businesses for solar energy systems to help permanently reduce operating expenses. When combined with other incentives, eligible farms & businesses can save 70-90% on the cost of solar with a REAP Grant.

About Us

North Carolina’s solar power and building performance expert. Founded in 2001, we’ve worked for 20+ years to improve the way people make and use energy.