- Kristyn Mott

- February 25, 2022

- 8 Minute Read

The Case for Green Building

Building Green. Green Building. We know it reduces negative impact on human health & the environment. But what about the return on investment (ROI)? Are green building certifications financially beneficial to developers and investors? Is the investment in healthier infrastructure also an investment in your finances? In short, yes.

In This Article

Healthy Building, Green Building, and Energy Efficiency

To start, we should differentiate between “healthy building” and “green building” certifications. While both meet the intentions of increasing sustainability of the building, healthy building certifications such as Fitwel and Well focus on the health and wellness of the occupants, whereas green building certifications such as LEED or NGBS focus on site impact, materials, and water & energy use. Energy Star is another popular building certification however its focus is solely on energy efficiency & is not technically a green or healthy building program.

Which program is the right program?

Although different in nature, these building certifications go well together! In 2021, around 30% of our projects pursued dual certification with either a green building, energy efficiency and/or a healthy building standard on the same project (I.E. NGBS & Fitwel Certified). We anticipate this trend to continue rising in 2022 and beyond.

If you’re on the fence about whether to pursue a sustainable building certification program for your project, any of them would be beneficial. According to a 2020 study from Aalto University’s Department of Built Environment, School of Engineering, “certifications should lead to an overall increase in the property value.” Beyond increasing property value, it can also improve ROI in several other ways.

Benefits of Healthy, Green, and Efficient Building

Across several of the studies mentioned in this discussion, there were five main benefits of certification, other than decreased risk, that positively affect ROI. They are as follows:

- Increased rental income

- Decreased operating expenses (ex: energy savings, lower maintenance costs due to more durable products, etc.)

- Increased occupancy/decreased vacancy

- Brand value of the certification, which may garner more interest in the property if properly marketed/displayed

- Increase in property value

Supporting ESG Goals & Risk Mitigation

Today, poor environmental performance is seen as an investment risk. Especially as transparency around corporate sustainability performance (example: ESG reporting) becomes more prevalent. If you’re unfamiliar with ESG reporting, it is the practice of disclosing data relating to an organization’s Environmental, Social, and Governance performance.

A recent 2021 study by the Center for Active Design, BentallGreenOak, and the United Nations Environment Programme Finance Initiative, stated that “The growing prominence of ESG criteria in financial decision making has transformed the real estate sector“. This claim was quantified by their two-part survey, whose participants consisted of “an international sampling of real estate investors representing USD $5.75 trillion total AUM”.

Highlights from the Survey

- 89.5% of respondents plan to enhance their company’s health and wellness strategy in the coming year.

- 74% agree that tracking data is a key priority for integrating healthy buildings into ESG strategy.

- 87% of survey respondents experienced increased demand for healthy buildings over the past 12 to 24 months, and 92% expect demand to grow over the next three years.

- The four main driving factors for investing in healthy buildings are Tenant Satisfaction, COVID-19, Human Health, and Market Differentiation

- 89% describe current demand for healthy buildings as either moderate or strong, with most of the moderate or strong demand coming from the office (87%) and residential sectors (61%), followed by retail (48%).

By certifying your property to a third-party building standard, investors will know that your property is lower risk than traditionally built buildings as the standard eliminates the concern of poor environmental performance.

Third-party verification of the green standard further reduces that risk by not only ensuring minimum program requirements and standards are met but that the standards are inspected and verified by an independent advisory firm; thus positively affecting their ESG portfolio.

Building for a Post-COVID Environment

It is also worth noting that in the post-COVID era, investors do not expect the drive for healthy buildings to slow down and that the increased demand is here to stay. In fact, millennials are already expecting their workplaces to address health concerns as employees go back into their offices.

Taking a proactive approach by designing better Indoor Environmental Quality, increasing daylighting, and certifying the building to a green standard, ensures the building is designed to be healthy while addressing the health concerns of future occupants. And while concerns are lessened for the individuals who will go on to use the space every day, the building’s owner will also see benefits:

- Increased Daylighting = 5-6% rent premium

- Increased Greenery = 5.6-7.8% rent premium for offices with low to high street-level greenness

- Increased Air Quality/Natural Ventilation: Higher ventilation rates are estimated at $6,500 to $7,500 per person per year in employee productivity

- Commercial building certification: 4-7% per square foot rental premium over non-certified spaces

- Overall: Healthier Employees & Lower Absenteeism

Staying Ahead of the Curve

With buildings contributing to nearly 40 percent of global emissions and the United Nations Framework Convention on Climate Change (UNFCCC)’s goal of holding the rise in global average temperature to 1.5˚C, we can reasonably assume that development rules and regulations will become stricter and more focused on reducing emissions. By staying up-to-date on the latest versions of certifications, developers can stay ahead of the curve by implementing these practices before requirements change, likely reducing the effort & cost required to meet new standards.

Benefits for Short Term Investments

For developers that do not hold their properties long-term, there is a benefit there as well. A 2013 study by the Appraisal Institute and the Institute for Market Transformation shows that green certifications can increase the appraisal value of a property if their value is articulated to the appraiser. To get an appraisal that takes the value of certifications into account, it is best practice to bring documentation to the table such as:

- Claims backed up by market analysis: better retention, increased rents, lower vacancy, and expected energy costs

- Cost of improvements & certification

- Utility bills or energy modeling results

- Certification reports

- Operations & maintenance plans that include green components

Tax Credits and Utility Incentives

Lastly, an additional financial benefit to building certifications is the tax credits and utility incentives that a project would not be eligible for if it was traditionally built. These additional incentives were not included in the referenced studies, therefore the actual ROI can be greater when considering these additional savings. Some examples of these incentives include the HUD Mortgage Insurance Premium, Fannie Mae Multifamily Green Financing, and (if you have a North Carolina Project in Duke Energy Territory) the Duke Energy Progress Residential New Construction Program. More information about these programs can be found here.

A full list of available incentives by state can be found at dsireusa.org or reach out and schedule a meeting with us to help you find what is best for your project.

How Much Does a Green Building Certification Cost?

Now that the financial benefits of certifications have been covered, what about the upfront cost? Certification fees for most green building programs are calculated based on either the project’s square footage or the number of buildings & units. Let us know if you have a project in mind, our team will be happy to map out specific costs for you.

By incorporating sustainability early on, the hard & soft costs can be decreased. For example, host a design charrette or have an integrative process throughout the life of the project to ensure that all parties are on the same page. This includes integrating your third-party consultants/verifiers as early as possible to ensure designs will meet the requirement of the certification.

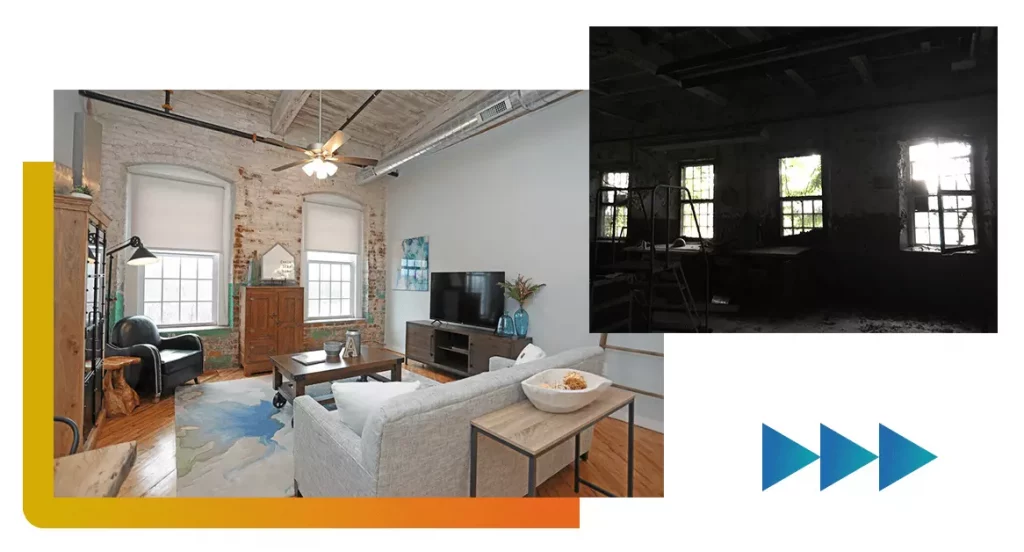

Another way to help with the increased investment to make your properties greener is to start a Green Revolving Fund. Lastly, costs can be cut down by implementing sustainable construction practices such as using low-carbon building materials, diverting construction waste, reusing materials, and redeveloping.

Interested in Learning More?

When choosing to pursue a certification, the SEM team will be there for you to help navigate the process. From choosing the right certification for the project or developing a green standard for your organization, to keeping an eye on applicable incentives, we will be there to answer any questions you have and make the process as smooth as possible.

We can also create a sustainability report for your project to accurately gather savings data and transform those numbers into a digestible, easy-to-read deliverable for either investors or future tenants.

Resources

For more detailed information regarding the ROI of certification, we recommend reading the studies referenced in this article. Here are links to each of these reports:

- Green Building and Property Value

- The ULI Blueprint For Green Real Estate

- A Review of the Impact of Green Building Certification on the Cash Flows and Values of Commercial Properties

- A New Investor Consensus: The Rising Demand for Healthy Buildings

- The Financial Impact of Healthy Buildings: Rental Prices and Market Dynamics in Commercial Office

Ready to Get Started?

Schedule a meeting with our green building specialists to review your project goals and challenges.

About Us

North Carolina’s solar power and building performance expert. Founded in 2001, we’ve worked for 20+ years to improve the way people make and use energy.